Finding Balance in Financial Freedom: The Power of a Freedom Fund

Executive Summary:

- Value of Freedom: Money should enhance life, not restrict it.

- Freedom Fund Concept: A non-retirement account offering accessible funds without tax penalties.

- Benefits Experienced: Greater peace of mind and the flexibility to make meaningful life changes.

- Balance in Strategies: Wealth should reflect your values and aspirations.

- Seek Guidance: Work with a financial advisor to explore the potential of Freedom Funds.

As the new year begins, I have found myself reflecting on fresh perspectives and changes within our family dynamics—particularly with the recent addition to our household. Each year, my wife and I take time to step away from the daily grind to evaluate our progress, set goals for the upcoming year, and ensure our financial decisions align with our values.

During one of these conversations, we came to an unexpected conclusion: we had been saving too much in our 401(k)s. Yes, you read that right.

One of our core values is freedom, and we believe it is one of the primary purposes of money in our lives. A few years ago, we felt a sense of pride in having met our long-term savings goals and built a solid emergency fund. But something still felt off. Despite our growing net worth, we felt like we were living paycheck to paycheck.

This realization led us to the concept of the Freedom Fund—a non-retirement account that provides accessible funds, without the penalties or restrictions that come with retirement accounts. While it is possible to access retirement savings early, the tax penalties and restrictions often make it an impractical option. Why should anyone dictate when and how we can use our hard-earned money?

Since we created our Freedom Fund, we have felt a profound sense of relief and peace of mind. It has allowed us to live more freely, be present in the moment, and remove the constant worry about our next paycheck.

The Freedom Fund has enabled us to live the life we want now, instead of waiting for 30+ years. In just a few short years, we have used this fund to expand our home, allow me to leave my corporate job to follow my passion, and even take my mother-in-law on a trip to celebrate her retirement. None of this would have been possible without reallocating some of our retirement savings into this fund.

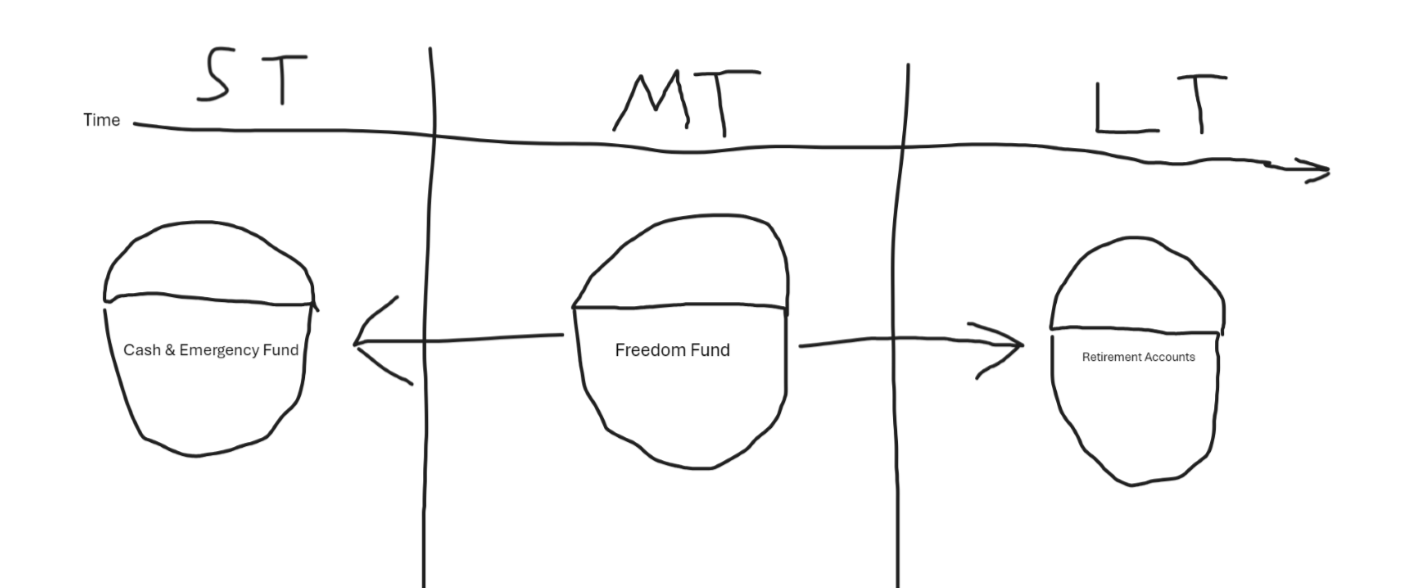

As someone who learns visually, I often find that illustrations help clarify complex concepts. Imagine a “bucket” approach where you divide your wealth into three categories:

- Cash for immediate needs,

- Retirement Funds for long-term goals,

- Freedom Funds, which can be used for either of the above.

While I may not be a professional artist, I hope my attempt to illustrate this idea resonates with you.

I understand that many financial experts may criticize this approach, as they typically recommend maximizing contributions to traditional retirement accounts for tax advantages and investment growth. However, I ask you to consider this: Do we live our lives based on a spreadsheet, or do we experience life in the real world?

In the end, balance is key. I am not suggesting we ignore retirement savings or dismiss the importance of taxes and returns—that would be unwise. What I am advocating for is a more intentional approach to your wealth. Many financial advisors overlook this crucial element—understanding what truly matters to you and making financial decisions that reflect who you are and the life you envision.

If this concept resonates with you, I encourage you to reach out to a coach, partner, or advisor to explore these ideas further. If you would like to learn more about Freedom Funds and how they can be incorporated into your comprehensive financial plan, please connect with us through the link below.